Hello, fellow business dissectors🫶

Welcome to Uninvited, the newsletter where I share with you business ideas no one asked for. Within REKOLT, we have a tradition: we often send ideas to the companies we love and when they don’t like them, I make them public.

If you have not subscribed yet, please do.

When I first moved to Berlin, I lacked a proper office space. Everywhere I went, I saw potential co-working spots - not just hipster coffee shops, but also laundromats and even dentist waiting rooms! So why can’t I crunch data in a supermarket?

I strongly believe that supermarkets are well-positioned to penetrate the workspace after seizing consumers’ lifestyles because of three underlying drivers that I explore in this piece of content:

Workers are shifting to a hybrid work format and looking for alternatives spaces beyond corporate offices and home

Remote work occurred a change in how we spend and where we spend

Supermarket’s bulimia: craving more touchpoints with consumers

This unveils a new white space for supermarkets: consumers’ professional life. I propose 3 different formats for ALDI to chase this growth lever.

Why ALDI? Well, I relate to the story of the two brothers who founded the company, which is not only inspiring from a business standpoint but also embodies strong family values.

Driver #1: Shift to hybrid work format in alternative spaces

Back to the office or full remote are not an option anymore

Post lockdown, some companies urged employees to get back to the office

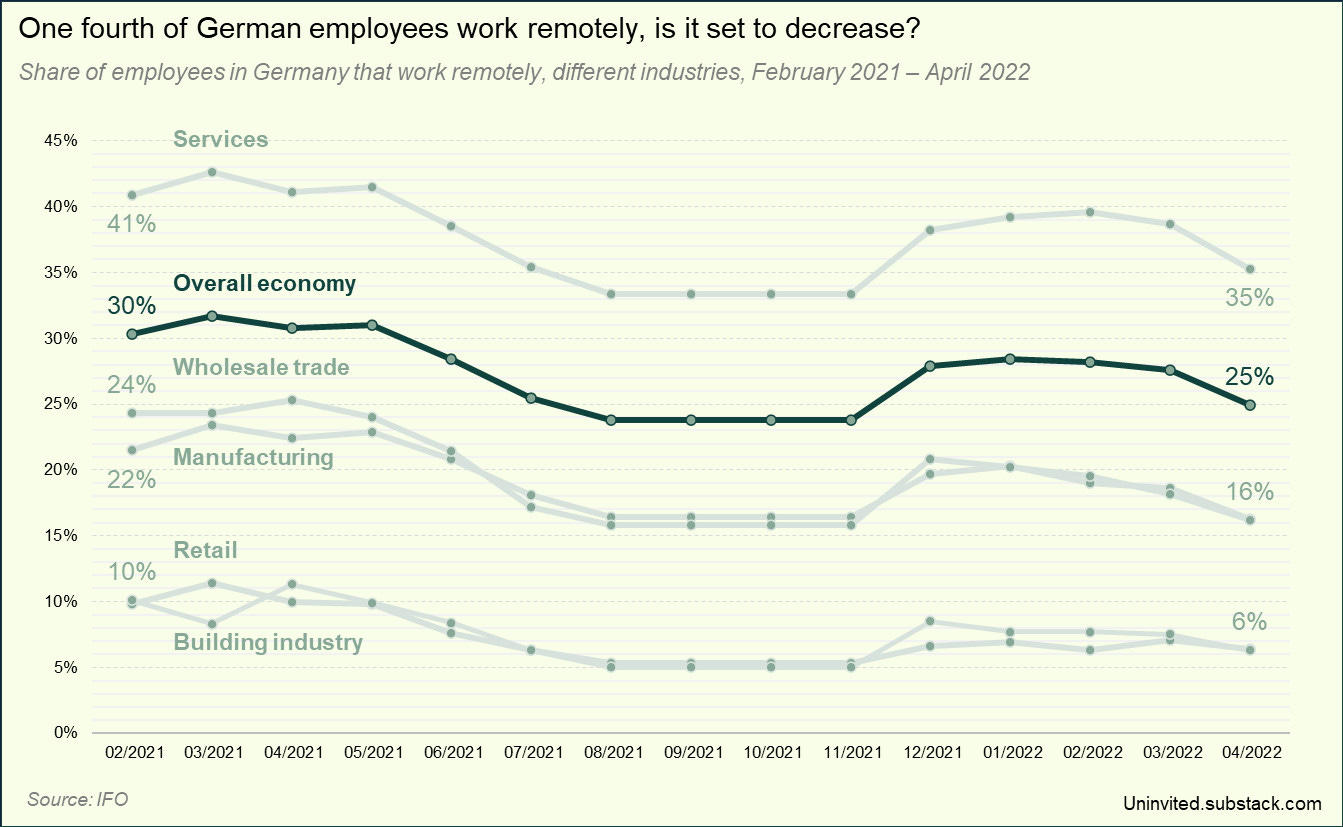

Remote work has been slowly decreasing post-COVID, but not all the employees went back to the office every day

In the most recent survey conducted by IFO, 25% of German workers are working remotely at least partially

A hybrid work model seems inevitable

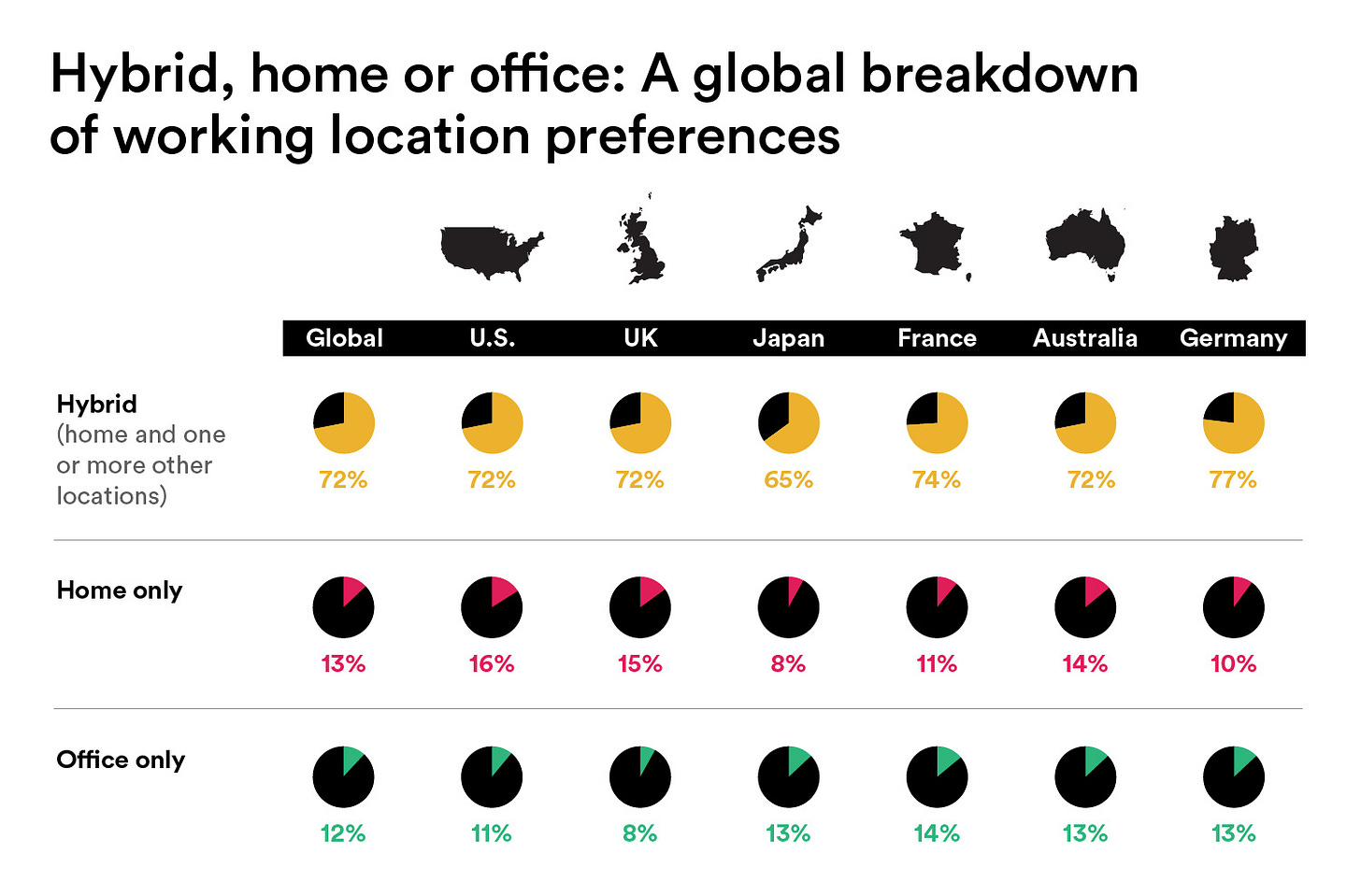

77% of knowledge workers prefer a hybrid arrangement that combines the home and the office according to a survey conducted by Slack, the highest share worldwide1

And so, companies are adapting to workers’ preferences: one of the top 10 challenges of global executives is to “optimize the hybrid work model” for 20232

Third spaces: setting boundaries with personal space while not going back to the office

Two opposing forces are at play: on the one hand, the reluctance to work entirely from the office, and on the other hand, the desire to establish clear boundaries between work and personal life

This tension gives rise to a need for a third type of space that is neither home nor office, respectively referred to as first and second places by the sociologist Ray Oldenburg

In his 1991 book 'The Great Good Place'3, he introduced the concept of third spaces

Third spaces “host the regular, voluntary, informal and happily anticipated gatherings of individuals beyond the realms of home and work”

Nearly one-third of employees embracing the hybrid model already work from alternative third spaces4 such as cafés, libraries, and hotel lounges,…

Work will increase or at least stabilize in a hybrid format and the flexibility of remote work will spread into alternative spaces more or less conventional: cafés, lobbies, museums, parks, virtual reality, department stores,… supermarkets?

Driver #2: Spatial move in retail spending

Remote working shifted the time we spend in business areas to our local neighborhood

So did our consumption and spending

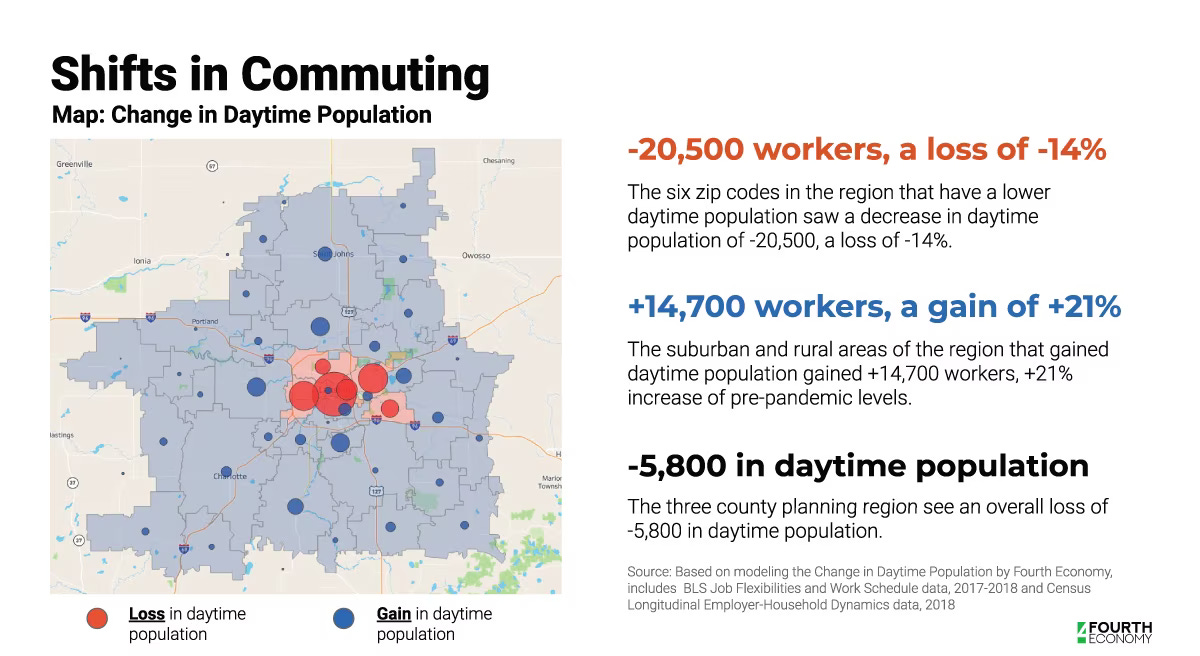

A study from Chris Worley, reveals the shift of the workers from the center to the suburbs in the region of Michigan5

The map pictured here shows changes in daytime populations before and after the pandemic. Areas in blue gained daytime population and those in red lost daytime population.

Same phenomenon in the UK6 where the peripheric areas of the city benefitted from increasing spend on local personal services, the opposite for the central areas

The geospatial distribution of workers also affects the spending behaviors of consumers at restaurants, services, and retail outlets, leading them to shift towards local points of sale located near residential areas. Among the types of points of sales that are systematically found in residential areas, grocery stores and supermarkets are well-positioned to benefit from this increase in local spending of money AND time.

Driver #3: Supermarkets’ bulimia, taking over more of our time and money

Beyond groceries

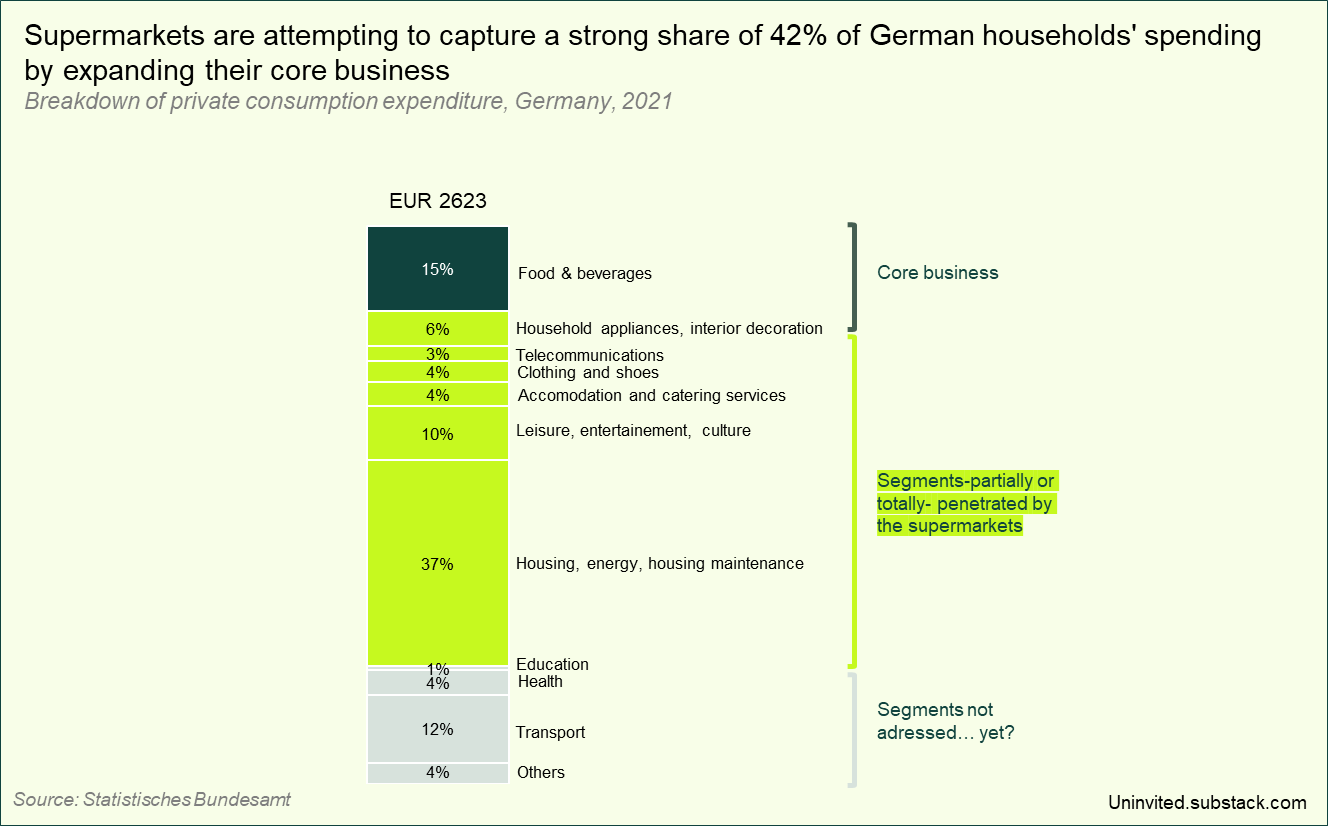

Supermarkets have the highest number of customer interactions, which they have utilized to expand their product range beyond their groceries’ core business

Thus, capturing by capillarity households’ spending in other segments

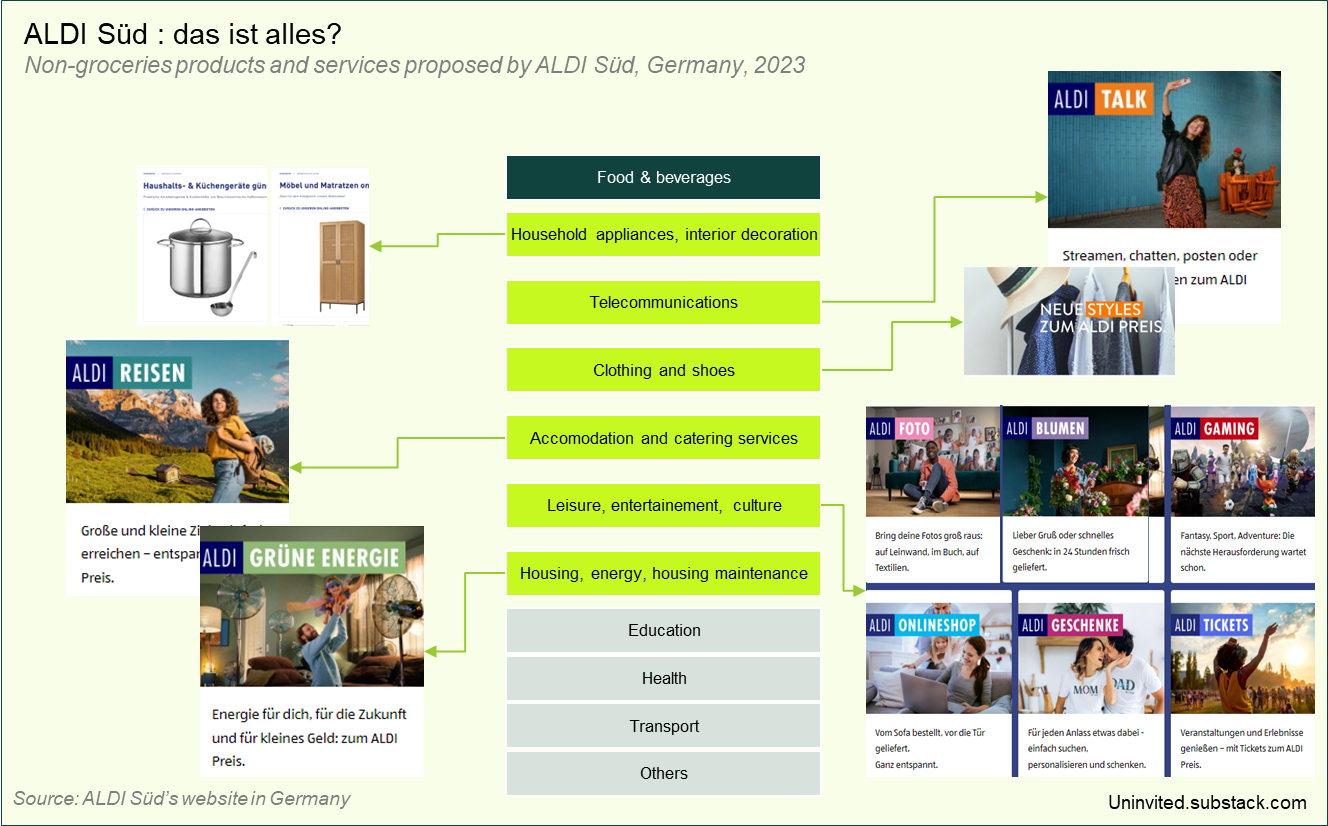

To qualify the above chart, let’s take the example of … ALDI Süd?

ALDI Süd already offers products and services beyond its core business and it will be no surprise if they penetrated the other segments too (Walmart in the US provides healthcare services7)

To better understand customers’ needs and tailor product/service ranges, supermarkets are increasing touchpoints with consumers

Touchpoints can only happen at certain times (shown in fluorescent green in the figure below). These are the hours outside of work.

The data collected by the supermarkets monitors consumers' “personal life”, leaving behind their “professional life” accounting for no more than half of their time awake at work. This does not provide a complete picture of who consumers are

Supermarkets are seeking more ways to attract consumer spending. Now, they will be turning to consumers' time as their next growth opportunity.

On the demand side, as hybrid work models become more popular, workers are seeking out alternative spaces to work, especially in residential areas close to home.

At the same time, on the offer side, supermarkets are expanding their reach beyond groceries and exploring new ways to fill their cravings for touchpoints with consumers.

I guess you can see me coming a mile off…

ALDI Workspaces: All-in-One Solutions for Today's Workplace Needs

Supermarkets are aiming to become one-stop shops for consumers, and they could do this by tapping into work time through three initiatives:

Bring your work to Aldi - Supermarkets running coworking spaces

Supermarkets are in the business of real estate. Online market share in groceries has been increasing since the pandemic, necessitating the implementation of new revenue streams in order to maintain the value of their brick-and-mortar properties.

They will also need to create different in-store experiences for the shoppers to bring them back to the physical stores.

One such strategy is to introduce co-working spaces within supermarkets, offering cost-effective and convenient workspaces to customers. This solution would allow customers to shop, work, and do other errands in the same location.

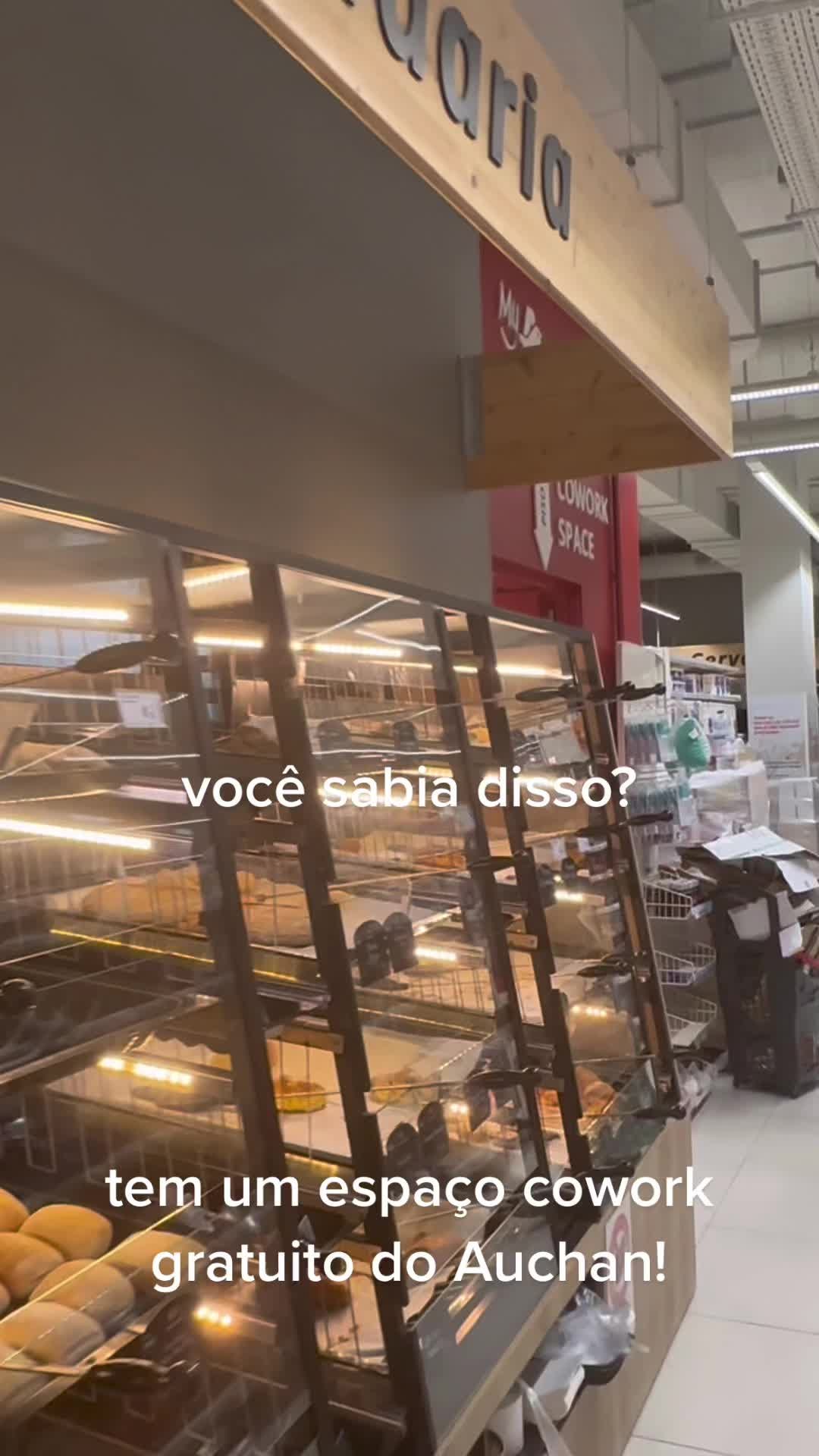

Seems unrealistic?

Some retailers have already initiated these projects; Auchan in Lisbon for instance:

Or Casino with their digital flagship store le 4Casino, which is one of the top-rated Casino stores in Paris according to Google reviews.8

Bring ALDI to your workplace - Installing mini convenience stores in other companies' offices

Ultrafast home delivery like Getir, Flink, and Gorillaz pose a threat to the traditional supermarket format. One way groceries are tackling the issues is through the convenience-focused model.

REWE To Go is surfing on this format of small spaces in high-traffic areas in Germany and ALDI launched its version of corner stores in Australia and the UK9 targetting young workers during their work breaks or on their way home.

So why not take it further to the last mile where the workers spend most of their time: at work? And have mini ALDI convenience stores in companies' offices, offering employees easy access to everyday essentials like groceries and restaurant food.

“If you don’t have time to come to ALDI, ALDI will come to you!”

French Start-up Totem serves as an inspiring example of the success of this offering, they install multiple formats of tiny shops in corporate offices.10

This initiative would also allow ALDI to penetrate the B2B market;

Increase your productivity with ALDI- Office supplies business line

This initiative is close to supermarkets’ core business and they are already serving some of these products in their stores.

The idea is to expand their range of products and extend to the B2B segment of office supplies. For more content on this market and a lot of paper-related puns, check the McPaper jam? page.

Supermarkets are already on a spree to capture the most of our lifestyle’s money spending.

They are leering at capturing our attention with their recent moves in the retail media sector: monetizing their traffic and data.

The next battle will be over consumers’ time, of which the largest not exploited reservoir is in the workplace.

To rephrase ALDI’s tagline: “Time is money, capture both”.