McPaper jam?

The largest German retail chain of stationary was crumpled by the pandemic, but McPaper revival is still possible

Hello, fellow business dissectors, I've been particularly obsessed with McPaper lately. They are the largest retail chain of stationery products in Germany. And besides their playful name, I find companies resisting the fatality of declining markets fascinating. There's a store near where I live in Berlin and it seems like they've had a golden age but now they're struggling. However, I strongly believe that they still have a strong potential for development.

Here is why👇🏽

We write less, we type more…

… even in Germany.

The digitalization of the economy has decreased the demand for traditional paper, office, and writing materials (Papier, Büroartikeln und Schreibwaren, mentioned here as PBS).

A paper-thin market

The dropping demand and the rising paper prices are squeezing profitability in the PBS retail market.

Aggressive players such as discount retailers, department stores, and online shops, have entered the industry and are putting more pressure on the prices.

Traditional German PBS retailers, mainly family-owned companies, are pushed out of business.

Rock-paper-scissors, a game few companies can still play

Enters McPaper.

Created in 1986, McPaper is the largest retail chain of paper, office, and writing materials in Germany.

Is McPaper on the top of the paper pile?

McPaper’s sales have been plummeting following the PBS market decreasing trend.

However, before the pandemic, McPaper seemed slightly resilient to the PBS demand slowdown.

COVID-19 hit the retail chain in a painful way whereas the sector was benefitting from a surprising 2.7% growth.

Why was the previously smooth McPaper crumpled by the pandemic?

In reality, the pandemic has exacerbated an already difficult situation for the company.

In 10 years, McPaper has been losing some of its main competitive advantages.

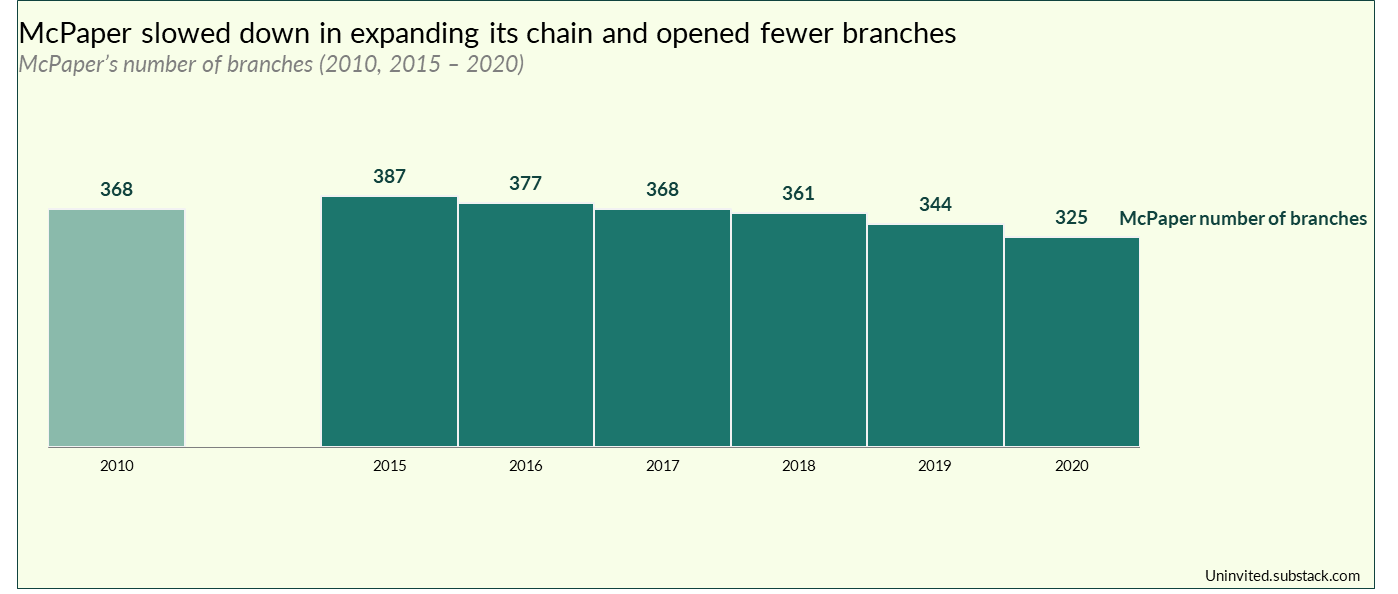

The largest chain ‘un-chained’ its retail footprint: fewer openings over the years

‘Un-chained’ its performance: the average branch of McPaper began performing at the levels of an average store in the market

‘Un-chained’ its margins: McPaper’s surplus collapsed and is now lower than the market’s

Despite its timid attempts at expansion, McPaper has been unable to benefit from economies of scale that should come intrinsically with being a retail chain.

McPaper’s branches perform in terms of sales just like any other stationery store and even lower margin-wise.

Wait! McPaper’s employees seem to be selling more than the competition

Revenues generated by the employees are 1.6x higher than the benchmark of the market…

… because prices are ~1.6x higher than the competition!

So, if there is just a different pricing strategy between McPaper and the market, then the volumes per employee sold are fairly the same.

Thus, the company does not benefit from any additional revenues due to its branding.

The shrinking margins might be explained by a demand shift of McPaper’s consumers from higher-priced products to lower-priced products.

The company’s gross surplus decrease cannot be explained by any change in the costs of material or costs of employment, which remained steady.

Also, McPaper was not prepared for the digital shift.

Stationery products used to be precursors in online sales, they fell behind the average retail sector

The substitution of brick & mortar by online sales in the PBS market benefitted to the companies that were already equipped with an e-shop.

7 major players account for ~1/5th of all online PBS sales while hundreds of websites contend for the rest of the market share.

The stationery e-shops battle for consumers quasi-evenly across age groups.

Buying stationery products online is not that niche

Despite intense competition for online visitors, McPaper is not on the same (web) page.

The company has a limited presence in the digital space, featuring neither an e-shop nor a strong social media presence.

It seems that the company has not devoted much investment to its technological transformation.

Stuck in the pen & paper age

Consequently, the company was not well-prepared to deal with the rapid digital transformation caused by the pandemic.

The peculiar situation is that McPaper is well-positioned to take advantage of the growth of online sales, due to the fact it operates ~30 Deutsche Post agencies alongside its stationary branches.

So, a customer may go to one of these postal agencies to collect a package of pens and notebooks ordered online… from a website run by one of McPaper’s competitors!

Will the company get its walking McPapers?

McPaper, the largest retail chain in the German PBS market was pulled by the decreasing context and was hit harder by the pandemic.

The company can still turn the situation around, write new chapters for its corporate strategy and reinvent itself.

McPaper’s revival is still possible.

Why be old when you can be vintage?

Creating a new branding - McPaper was born in 1987 and has been selling mainly stationary products: it is an old company selling old products.

And because it is old, it can be genuinely vintage. And surf on its established identity and the current vintage craze by rebranding and marketing its concept as truly classic and stylish.

The menu, please!

Unbundling the offer - No need to recall the strong similarity between the name of McPaper and the famous fast-food chain.

Why not go further with similarities and offer menus or verticalized offers instead of an assortment of products?

McPaper could unbundle its actual offering into specialized categories that are on the rise and with high margins: art supply, creative DIY, home office materials, calligraphy…

Crib notes

Read the customer’s mind - An adage as old as McPapyrus states that you should listen to your consumers.

The analysis of >10 000 customer reviews for McPaper branches does provide pillars of improvement according to the customers (in-store service quality, pricing policy, and product range are among the top 3)

If you can’t beat them, join them

The unavoidable digitalization and data-ization - First level up on the omnichannel with an e-shop and a stronger presence on social media (collaborations with rising creators of stationery products or content on TikTok and Instagram would be a good start).

Then leverage the data.

Then innovate.

Easier said than done but that’s the march of history.

Thanks for reading