Brot-as-a-Service

German artisan bakeries are struggling, but they might be one app away from reversing this fatality

Hello, fellow business dissectors🫶

Welcome to Uninvited, the newsletter where I share with you business ideas no one asked for. Today I’m writing about two themes I’m passionate about: food and bringing back power to the small players of a market. Get ready to be spoiled with half-baked puns and sugar-coated reasonings.

If you have not subscribed yet, please do and read along.

“Like a rabbit caught in the headlights”

This expression is so eloquent that you can almost feel the paralysis in your arms and the blackout in your brain. It’s there, it’s coming for you, it’s unavoidable, so what can you do? Keep breathing.

If you were a German baker, you would wake up at 3 am, be ready at 4, start preparing your dough, shaping it, and get it in the oven by 5 am. The smell of freshly baked bread would fill the air, and customers would start coming in before 7 am. But there are fewer and fewer customers coming, as they would rather go to the self-service baking station at the Lidl in front of you to get a cheaper Viennoiserie. As a dedicated baker, the pressure on you is increasing with rising energy and raw material costs, and to add to the burden, you are close to retirement and cannot seem to find young apprentices ready to take over the bakery. This is the context you have to bear daily, but what can you do? Keep kneading.

And as in all fights that are lost in advance, there are ways to reverse the situation. In this piece, I will discuss why artisan bakeries are doomed to die (“das Bäckersterben”), and how German bakers are one app away from changing the situation. The solution is what I call "Brot-as-a-Service".

Take a pretzel and let’s deep dive.

Bakeries falling on the buttered side

The demand for bread and baked goods consumption in Germany has stagnated

The recent sales increase of 3% in 2021 and 9.5% in 2022 is not due to volume growth but rather reflects significant consumer price increases of 3.3% and 13.5% respectively, for bread and cereals products1

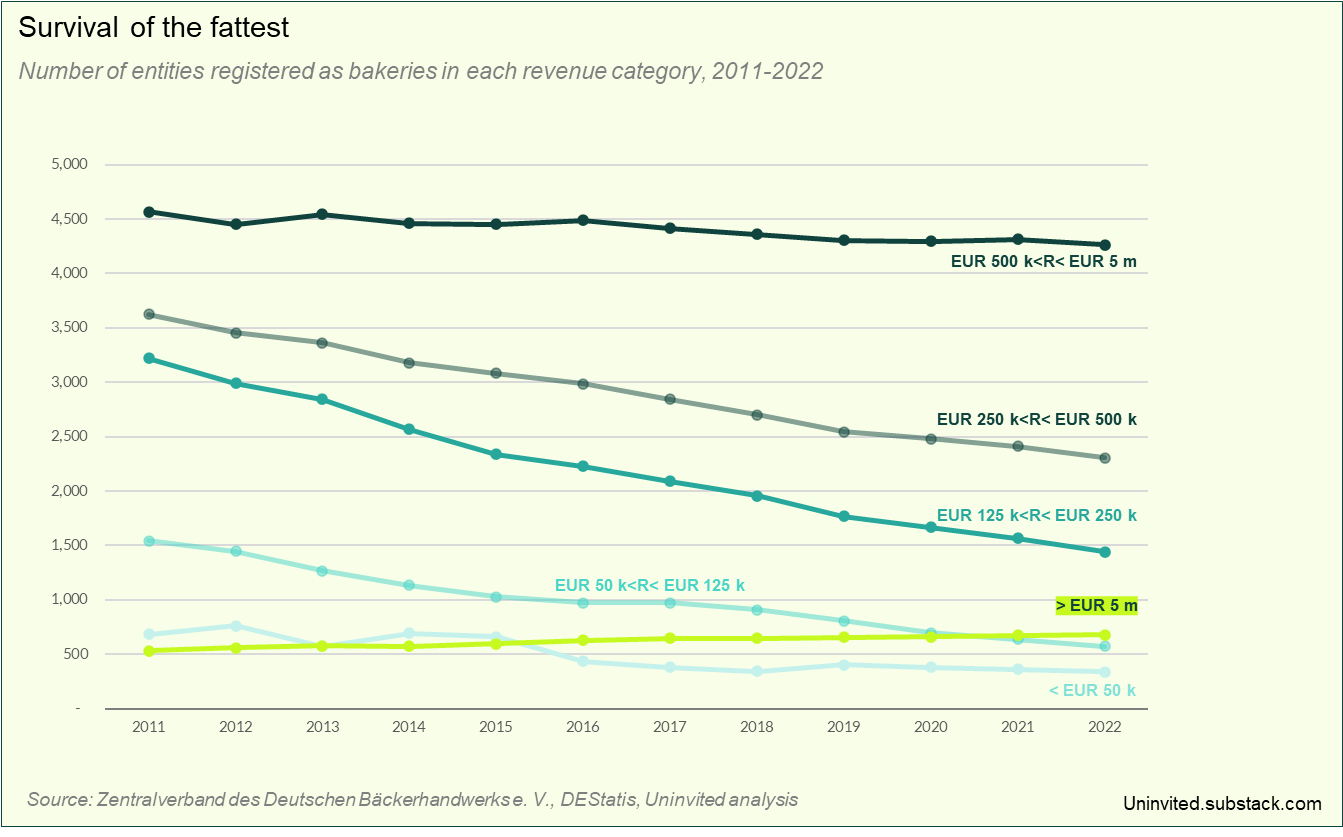

The number of German entities encompasses both independent bakeries and chain stores with multiple locations, this number dropped below 10 000 companies (~< 50 000 branches)

The market lost one-third of its players, indicating closures and significant consolidation

But who are the breadwinners in this market?

Bakeries with yearly revenues below 500,000 EUR have experienced closures, particularly those earning less than 125,000 EUR. Their cost structure makes them doomed to close

Local bakery chains with ~10ish points of sale, and revenues between 500,000 and 5 million EUR are holding their ground

While larger chains with over 5 million EUR in revenue are increasing, reflecting a trend of consolidation in the market

The survivors of this market seem to be the largest bakeries that can benefit from economies of scale. Or are they?

Don't be fooled by the scent of bread, retailers will always find a way to stick their noses in the oven

The market structure can be divided into three categories: supply bakeries, system bakeries, and artisan bakeries

Supply bakeries are industrial players that offer packaged and other products for self-service shelves in supermarkets. Packaged ready-to-eat and partly or totally frozen products are made for home baking. Bake-off goods, such as pre-baked fresh and frozen dough, are either provided to bulk customers or baked in back stations.

These companies can be independent (eg. Harry-Brot)

Or owned by the major retailers and thus supply exclusively their retail network (eg. Bäckerei Wünsche supplying Edeka Südbayern or Bonback the bakery belonging to the Rewe Group)

System bakeries are chains, either self-operated or franchised, with brick-and-mortar stores and in-store bakeries. They are either “classic bakery chains” or “self-service discounters”

Companies such as Heberer supply both their 200 branches with bake-off goods and also major retailers

Discounter-style bakeries (e.g. Back-Werk, BackFactory) offer low-cost goods and have low labor intensity

Artisan bakeries are B&M stores, though some small chains are considered artisanal since they don't own industrial lines

The distinction between the different market categories is often blurred

Independent bakeries are threatened by competition from new products (bake-off, frozen, and partly baked bread) and new distribution channels (self-service discounter stores with more competitive costs, retailers with more touchpoints with the consumer)

Increasing market polarization is making price a major factor in buyer choice => beneficial to retailers

The shift in working and professional lifestyles has resulted in consumers shopping less often and preferring one-stop shopping, again, beneficial to retailers

Consumers’ preferences seem to be a bit volatile among the channels, but the baking stations in retailers’ stores are clearly the winner leaving only one-fifth of the consumers to artisan bakeries

What’s happening with the pre-checkout bakeries versus baking stations? Here is my personal interpretation: When pre-checkout bakeries were first introduced, they were typically operated by large bakeries like Steinecke. Then, retailers started their own in-store baking stations, offering lower prices just a few meters from the pre-checkout area. This led consumers to shift away from pre-checkout bakeries, resulting in their operators leaving the market. Today, retailers are taking over the pre-checkout bakeries allowing them to capture all the baked goods sales within their store

In addition, to the external pressures (competition, rising costs,…), artisans are unable to renew their profession.

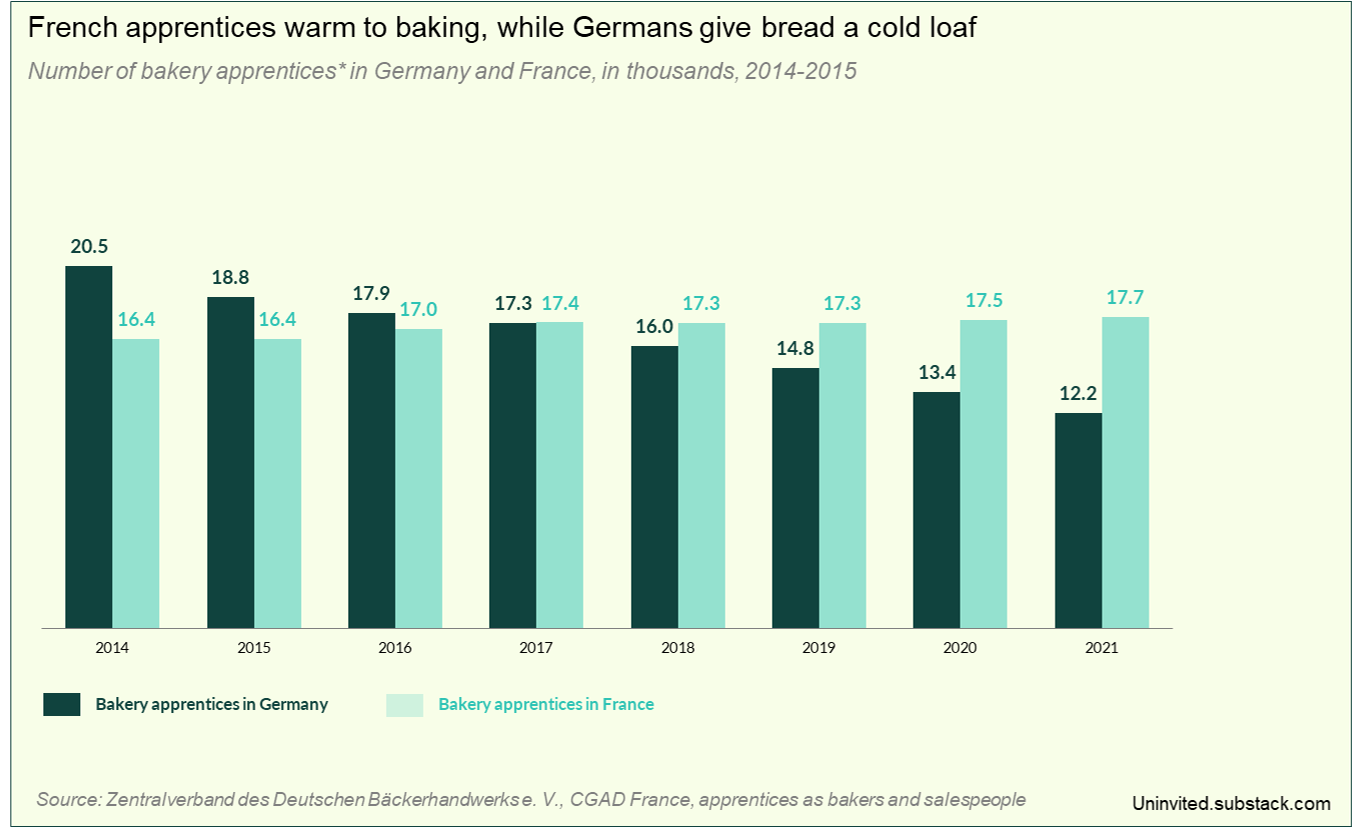

In 2021, 40% fewer young German apprentices than in 2014 were interested in bakeries, making it difficult for the industry to continue to grow and innovate

Whereas in France, bakery jobs are becoming increasingly attractive for apprentices

Traditional bakeries have also faced pressure from rising raw material costs and energy

Artisan bakeries are facing retailers’ competition with fewer resources.

The brot-chain paradox

Just when you thought things would be smooth sailing for the big players, I'm sorry to burst your bubble, but that's not the case

Although large bakery chains benefit from economies of scale in some areas, such as inputs, operations, and marketing, it is not enough to ensure success

For example, Steinecke Brotmeister, the largest bakery chain in Germany, has been struggling in recent years

The company has closed 30% of its branches over the last five years and has experienced negative operating margins in the past years

Steinecke’s management has acknowledged that

"It is becoming increasingly difficult to position ourselves against the competition in a way that is perceptible to the consumer" - Steinecke Brotmeister management

Even large chains cannot compete with retailers, and here is why:

Retailers often use bread as a “loss leader” to attract customers as they can make profits on other products

Large chains often have industrialized production which is standardized in terms of costs and processes, but this results in standardized taste and offerings (some large chains do supply retailers, so they offer the exact same quality in their stores as the one in the retailers’ baking stations). They also have standardized sales processes. Therefore, on the one hand, the production is standardized and on the other, the customer experience is also standardized, just like with retailers. So customers expect to pay a similar price to that of retailers for the same quality and experience.

In fact, they are stuck in what I call the “brot-chain paradox”: the more a chain standardizes to achieve scale, the more it enters into the playing field of retailers and will inevitably lose

The context is affecting artisan bakeries and large chains are struggling with competition. In the middle of these two options’ spectrum, there is a resilient model: chains with less than a hundred points of sales and tens of millions of euros in revenue are performing well

Although it's not all sugar and jam, they remain profitable

These companies have a specific feature of being chains so with a bit of standardization but not too much. For instance, Bäcker Wiedemann himself declares that:

“We do not use industrial baking lines […] Our bread, rolls, cakes and snacks are made daily and sold in our own branches” - Klaus Wiedemann

This allows them to offer premium quality and reflect it on the price

Also, a not-so-rigorous approach reveals that the smaller the chain, the better the customers’ reviews

This phenomenon may be explained by the increasing trend of localism, customers prioritizing products from nearby producers and suppliers. Local customers may be more likely to support small bakeries in their community, rather than large chains or industrial producer

This would definitely be a trend favouring small bakeries by promoting their use of locally sourced ingredients and traditional baking methods

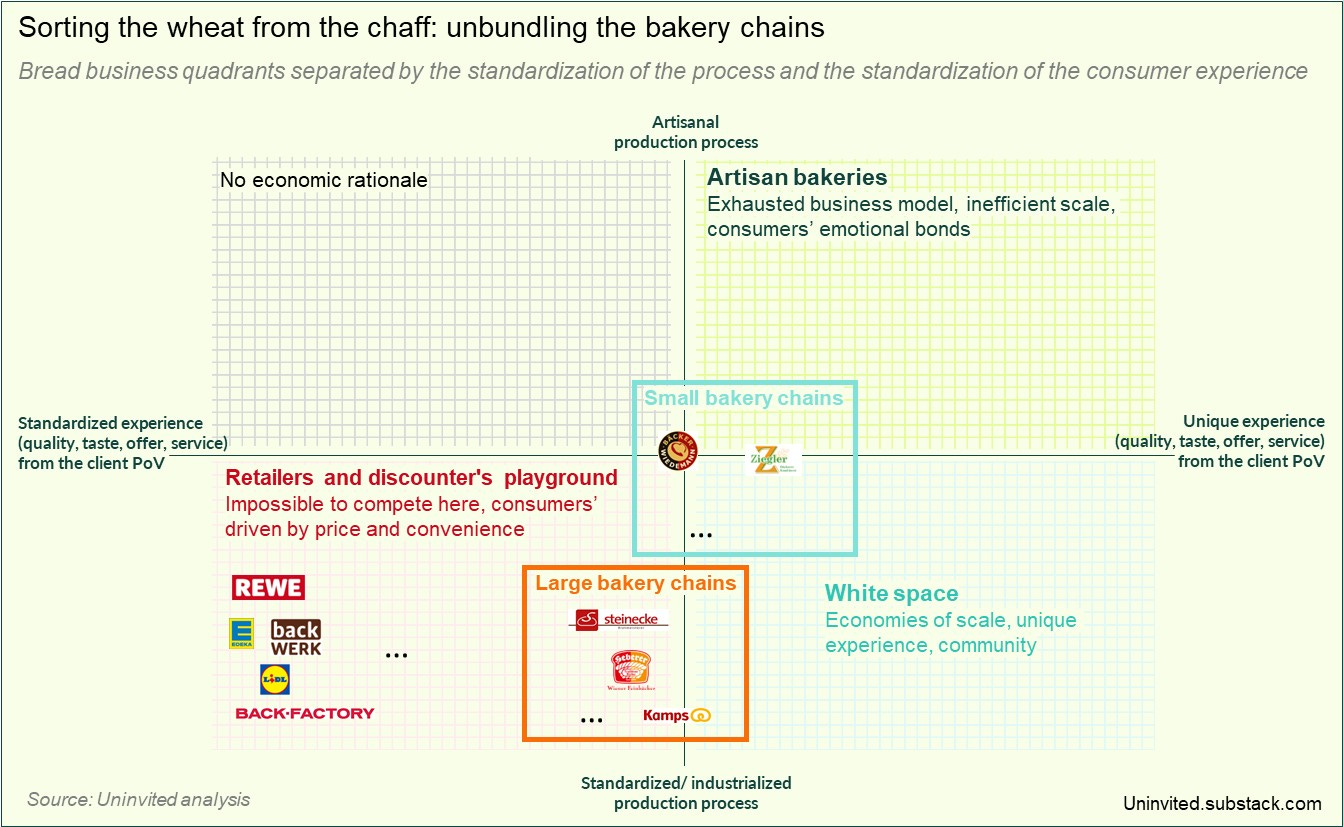

Ladies and gentlemen, the matrix

So when we mix all these ingredients: rising costs, standardization or not, competition from mean retailers, the size of the oven, and unique experience,... and we keep kneading and let the yeast rise… we get the all-time consultants’ favorite framework: the four quadrants matrix

The matrix is divided into four quadrants based on two dimensions: the production process on the vertical axis and the customer's experience on the horizontal axis

The top right quadrant is where artisan bakeries stand. It offers a unique experience in terms of quality, taste, offer, and service, and has an artisanal production process. However, the business model is exhausted due to inefficient scale and the context described above. However, the support local movement and the emotional bonds can pull these players

The top left quadrant consists of an artisanal production process and a standardized experience. This would not have an economic rationale as it would incur a premium on the products’ price that can’t be offset by the “basic” experience provided to the consumer

The bottom left quadrant is the playground of retailers and discounters with a standardized process and standardized experience. They benefit from economies of scale, and the consumer here is driven by price and convenience. This is the danger zone! Any player entering this quadrant would face rude competition from retailers and discounters, and large bakery chains are suffering due to their inability to afford the same price structure

The bottom right quadrant offers a standardized process and a unique experience with quality, taste, specific offerings, and nice service. This quadrant is a white space and the best of both worlds unbundling the model of the large chains. It offers economies of scale while providing the consumer with a great experience and the ability to support the local community. Small bakery chains are positioning themselves here, and they have been resilient

I see the white space quadrant as the future of artisan bakeries, and this is where the Brot-as-a-Service platform would position itself.

Brot-as-a-Service: the best thing since sliced bread?

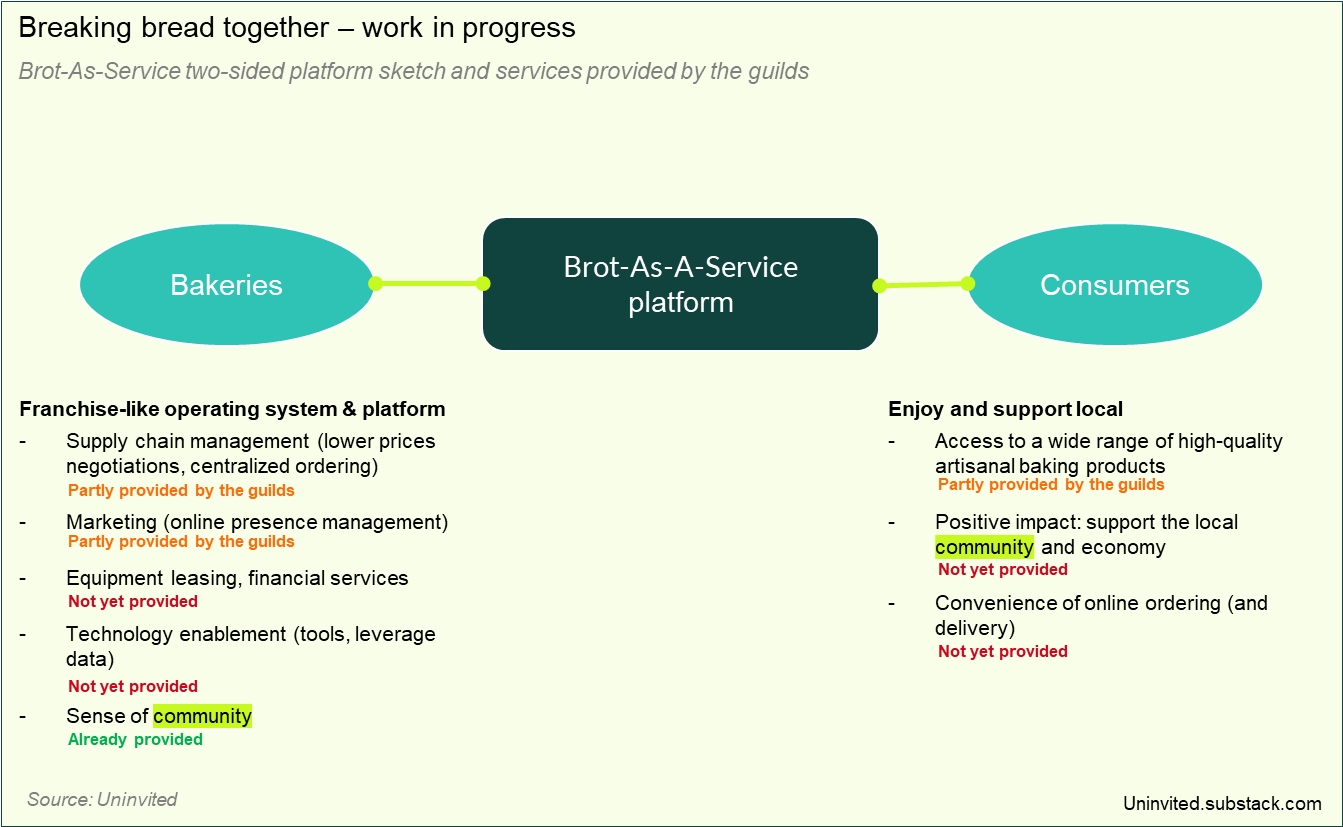

A two-sided platform

Here is what I propose: an intermediary model that combines the authenticity and quality of a local traditional bakery with the cost structure of a large company, allowing small bakeries to benefit from economies of scale

Inspired by Slice2, a successful American company that helps small pizzerias operate better

"Brot-as-a-Service" would provide small traditional bakeries with the necessary tools to streamline their processes, reduce their costs, and increase their reach

By working together, small bakeries can offer consumers an authentic, high-quality, and convenient experience

It is like equipping independent bakeries with a franchise-like platform, creating an artificial scale effect, providing them access to technology, marketing, shared services, and a supportive community that can help them grow their businesses

Features for the bakeries:

Supply chain management - direct impact on the bottom line: negotiate lower prices on ingredients and supplies with suppliers, and pass those savings on to the bakeries, providing a centralized platform for ordering ingredients and supplies, making it easy for bakeries to compare prices and find the best deals.

Marketing and promotion - be where the consumers are: online presence management, shared social media managers, advertising optimization, customer engagement

Business consulting: 1-1 operations improvement, pricing and marketing strategies, growth opportunities

Analytics and insight: leveraging internal and external data, sales trends, customer feedback, demand prediction

Equipment leasing, targeted financial services, administration - as the saying goes “every company is a fintech”: specific bookkeeping, accounting and tax services, machinery leasing, freeing them from administrative tasks

Features for the consumers:

Access to a wider range of unique and high-quality artisanal bread products, that may not be in larger chain stores

Convenience of a centralized online platform for ordering and delivering fresh bread products (the delivery part is tricky as bakeries might not have their own fleet: in such cases, they may either rely on third-party delivery platforms or provide delivery services themselves, as consumers are likely to order from nearby bakeries.)

Supporting small, independent businesses and contributing to their local community and economy

The BaaS Meister

German artisan bakers are organized in guilds that mirror the German administrative structure

The Zentralverband des Deutschen Bäckerhandwerks (ZDB) is the central guild representing German artisan bakers. There are 16 regional guilds at the Lander level, and then it cascades again at the district or city level. Bakers are close to their representatives, and each level of the organization provides different services to them

In fact, 60% of the bakers are members of their local bakers’ guild

The Zentralverband des Deutschen Bäckerhandwerks is well-positioned to take over the BaaS project as they already have established relationships and credibility with the majority of German artisan bakers

If a private company or another player were to undertake this project, they would need to address over 9,000 bakeries to recruit them to the platform, resulting in high acquisition costs and a lack of credibility and trust that would need to be built, which would elevate the barrier to entry

Part of the services offered by Brot-as-a-Service are already available to the bakeries. However, in my opinion, these services require a "refresh" and stronger technology integration to enhance the platform's capabilities for the bakeries

Aso, for the consumer-facing side, an app called "Bäckerfinder3" already exists, which provides information on bakeries and tastings organized by the association. However, the app lacks the transactional capability for consumers to directly order bread from nearby bakeries.

Uninvited

It would break my heart to witness the decline of German craftsmanship's crowning jewel. Brot-as-a-Service is my uninvited idea to overturn this trend. I will invite myself to the mailbox of the central guild of Central Guild of German Artisan Bakers (ZDV) and hopefully present it to them.

Thank you for reading. Two more things:

Since I'm new to the newsletter game, I'd love to hear your thoughts and feedback to help me improve.

If you appreciated this post, please consider sharing it with someone or posting it on LinkedIn

Meryem

https://www.destatis.de/DE/Home/_inhalt.html

https://slicelife.com/

https://play.google.com/store/apps/details?id=de.innungsbaecker.baeckerfinder&gl=DE